Imagine that you are driving peacefully and enjoying the scenery on the highway. Suddenly, a deer jumps out, jolts the vehicle, and crashes! Your vehicle gets damaged. In this scenario, you can breathe easy, if you have comprehensive insurance coverage as the repair and damage expenses are covered. Know more about this beneficial coverage and make a calculated decision!

No matter what size of car you own, it is not only an essential part of our daily routine but also carries unforgettable reminisces. However, your car also holds a financial burden when it gets totaled, stolen, or even worse. This is where comprehensive insurance coverage kicks in and shields you from unforeseen events that lead to major setbacks.

This blog serves as a roadmap to understanding the gory details of comprehensive coverage, what it covers, its benefits, and its costs. We will also explore real-life scenarios where this insurance prevents financial stress.

Let’s delve in, gear up with knowledge, and make an informed decision!

Understanding Comprehensive Insurance Coverage

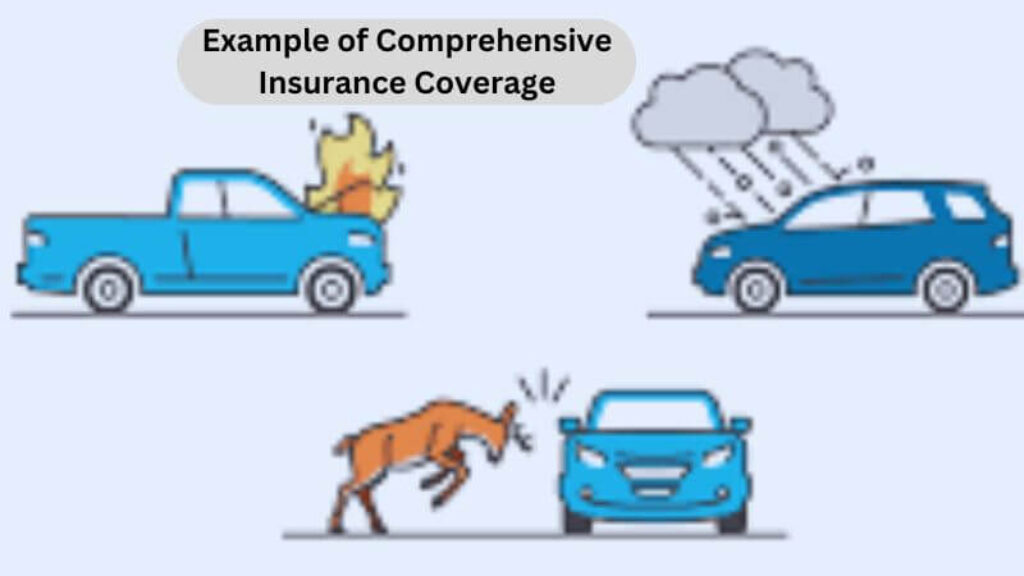

Comprehensive insurance coverage is a type of vehicle insurance that covers your car damages from a variety of factors excluding collision. If your car gets damaged by a break-in, tornado, crushed, vandalized, dented by running animals, etc. comprehensive insurance coverage will cover the repair expenses for you.

This insurance is designed to pay for damage caused by falling trees, vandalism, animals, theft, and natural disasters. This coverage is one of the components of automobile policy. Although comprehensive coverage is optional for car owners, this insurance can save you from a huge financial burden after a massive car damage.

Example of Comprehensive Insurance Coverage

Let’s say, a teacher residing in Colorado drives a Subaru Forester. She has comprehensive coverage insurance. One day, when leaving for the school, she saw that a large branch of the tree had fallen onto her car. This has caused significant damage to the windshield and roof of the car.

With comprehensive coverage, she doesn’t have to pay the full cost of repair as the insurance company will take care of the expense. When she shared the incident details with the insurance company, they gave her a list of approved repair shops where she got her car fixed quickly and conveniently without needing to negotiate with other repairers. The cost of repairs was worth $1500.

Without this coverage, this figure would have been financially burdensome, and she would have delayed fixing her car which could have caused more damage.

This scenario illustrates how comprehensive coverage is beneficial in unforeseen events. Here are other real-life examples where comprehensive coverage comes in handy.

Benefits of Comprehensive Insurance Coverage

Typical car insurance doesn’t cover the damages of your own vehicle as it merely protects against third-party property damages and bodily injuries. Therefore, it is essential to protect yourself against those accidents that lead to expensive car repairs. Here, getting comprehensive insurance is the right choice for getting full coverage of unforeseen events.

The following is the list of benefits that comprehensive insurance coverage offers to the insured:

Pays For the Damage Repair

A comprehensive insurance plan provides adequate coverage to the insured vehicle. Your car gets fully covered against a variety of accidents such as natural disasters, animal collisions, falling objects, man-made disasters like riots, theft, and more. If the insured vehicle gets damaged by any of such causes, he/she gets paid for the repair expenses minus the deductible amount.

Minimize Financial Burden

No matter how big or small the damage is, your car is a machine, and repairing it comes with a big price tag. As full coverage insurance protects you against a variety of accidents, you get compensated for the losses incurred in an incident. This means getting this coverage helps you to minimize the financial burden that comes with an accident.

Rental Car Coverage

Comprehensive insurance also helps you cover the cost of the rental car that you use while your own vehicle is getting repaired after an accident. This means you can carry out your daily activities without any disruption.

Also, check– How To Save Money For Your Business- 12 Smart Tips

Network Repair Garages

Most insurance providers offer cashless repair garages near your location with comprehensive coverages to get your damaged car repaired conveniently and quickly. This means you don’t need to file the claim and keep following up with the car insurance provider in case your car gets totaled in an accident. You need to contact the network repair garages and the rest of the things will be taken care of.

Personal Accident Coverage

Road accidents can quickly turn into tragedies that not only damage your car but also your personal life. Comprehensive coverage offers adequate compensation for accidents that lead to car damage, personal injury, or even death. A well-rounded coverage provides ample reimbursement if you get injured and your car gets damaged in an accident.

Third-Party Coverage

Comprehensive insurance coverage protects the third-party injuries and property damages caused in an accident. This means if your car does any property damage or physical injury, this coverage will pay for the third-party liabilities.

Repair or Replacement

Comprehensive coverage pays for the repair in case your car gets badly damaged in an incident. In case, your vehicle reaches a state where it becomes irreparable, it gets replaced with a new one (if covered in the policy).

How Much Does Comprehensive Insurance Cost?

The precise cost of comprehensive insurance depends on a variety of factors including:

Although all these factors impact the total cost of your coverage, the average comprehensive car insurance cost in the United States ranges between $650 to $1200 annually. The cost of comprehensive coverage is comparatively higher than a liability-only policy. However, you can choose a higher deductible amount to lower your premiums and save money.

How Does Comprehensive Insurance Coverage Work?

Basically, comprehensive insurance coverage protects your car from damage caused by a variety of accidents except for the loss that occurred due to collisions. So, if any day your car gets damaged or stolen in covered scenarios, you will follow the below-mentioned steps to get the claim quickly.

What Comprehensive Insurance Cover?

Comprehensive coverage insurance protects the insured against damages caused by non-traffic-related accidents. Here is the list of a variety of accidents that are covered in comprehensive coverage.

What Comprehensive Insurance Cover?

Comprehensive coverage insurance protects the insured against damages caused by non-traffic-related accidents. Here is the list of a variety of accidents that are covered in comprehensive coverage.

What is ‘NOT’ Covered in Comprehensive Insurance Coverage?

Although comprehensive provides full coverage against most incidents, it has some exclusions that you need to understand before opting for it. Here is the list of events that are not covered by this policy.

Is Comprehensive Insurance Coverage Right For You?

Choosing comprehensive coverage is a wise decision but you need to consider some factors before purchasing it as follows.

Frequently Asked Questions About Comprehensive Insurance Coverage

Is comprehensive insurance full coverage?

Comprehensive insurance provides full coverage from a variety of accidents except collisions. This policy has some exclusions that need to be considered before opting for it.

What is comprehensive insurance?

Comprehensive insurance is a component of the automobile policy that is designed to pay for damage caused by falling trees, vandalism, animals, theft, and natural disasters.

What is collision insurance?

Collision insurance covers the damages that occurred to your vehicle in case of a collision with another vehicle.

Should I get comprehensive insurance for an older car?

If you have an old car, having comprehensive insurance or not depends on your affordability. For example, if you can afford to replace the car in the event of theft, you should probably avoid taking this policy. However, if you want to avoid paying out-of-pocket expenses to replace your lost vehicle, you should consider adding this coverage to your insurance policy.

What is the cost of comprehensive insurance coverage?

Although several factors (as mentioned in the blog) kick in while calculating the precise cost of comprehensive insurance, you can expect to pay between $650 to $1200 annually.

Is comprehensive coverage required?

Comprehensive coverage is not mandated by the law. However, if you want to avoid paying out-of-pocket expenses for repairing or replacing your car after an incident, you should consider adding this coverage to your policy.

What are the disadvantages of comprehensive coverage?

The biggest drawback of comprehensive coverage is that it doesn’t cover the damages incurred due to collisions. Car owners are required to take additional collision coverage to get protected for such events. Also, it doesn’t cover personal items stolen or damaged inside the car in the event of theft or accident.

The Closure on Comprehensive Insurance Coverage

By now, you have understood what is comprehensive coverage, its benefits, inclusions, exclusions, costs, and more.

If you are taking this policy, consider reading your policy thoroughly to check what is covered and what is not to avoid getting surprised at the time of claim.

As this coverage comes with a significant cost, you can save on your premiums by getting multiple quotes from different insurance companies, asking the right questions, and choosing the best with a competitive price.

Carefully consider your budget and needs and pick the right one from the right provider!