Managing funds strategically is the foundation of any successful relationship. But let’s admit it, calculators and spreadsheets are not only confusing but also a big turn-off. Worry not! We will introduce you to a strategic weapon that will make money management a breeze.

Here, we are talking about the best budgeting apps for couples that will help you reach your financial goals together. Let’s dive in!

More than 75% of smartphone users utilize at least one application to manage their finances as this tool helps them handle their funds like a pro.

As you are sharing your life with someone, your financial decisions can impact both of you.

Couples who seek to build long-term wealth should know where their money is going. Strategic financial planning can help you keep a vigilant watch on your expenses and save money for the future.

However, doing back and forth in spreadsheets or tallying numbers using a calculator can be overwhelming. Here, couples budgeting apps can make your life easy and help you reach your long and short-term financial goals.

Using the right set of tools you can manage your funds smartly. However, choosing the budgeting apps for couples is quite challenging as the market is flooded with options each claiming to be the best.

Fear not love birds! We have meticulously researched the market and dug out the best budgeting apps for couples highlighting the benefits and key features of each.

Get ready to plan the best romantic surprise without worrying about money as we help you pick the perfect app that aids in achieving financial freedom.

Let’s dive in and keep money stress at bay!

07 Best Budgeting Apps for Couples to Manage Money Like a Pro

It is not a secret that a money crisis can lead to conflict between couples. Fortunately, with the help of a couples’ budgeting app, you can empower your relationship and approach your long and short-term financial goals together.

Here is the list of best budget apps for couples that offer financial freedom to the couple and strengthen relationships.

Quicken Simplifi

Quicken Simplifi is one of the best budgeting apps for couples which comes with great fund management strategies. This is a mobile-only platform that is specifically designed for couples to help them efficiently manage their finances together. This couple budgeting app encourages and motivates to reach financial goals.

Key Features of Quicken Simplifi:

Pros and cons of Quicken Simplifi:

- The User-friendly interface offers a simple experience to couples who are new to budgeting.

- Designed to help couples manage their funds together easily.

- Automatic bill payment reminders.

- Categorize transactions automatically.

- Limited option for investment monitoring.

- Requires paid subscription.

- Comparatively fewer features than Quicken desktop software.

Pricing Structure: Single paid subscription plan at $5.99 per month.

- Google Play Rating: 4.0

- Apple Store Rating: 4.0

Mint

Mint from Intuit is another best free budgeting apps for couples. This budgeting app is widely popular for providing a one-stop shop for tracking, managing, and monitoring personal finances. This app enables couples and individuals to keep track of monthly spending and expenses. This budgeting app is an excellent choice for those who are looking for a user-friendly and free tool to manage their funds.

Key Features of Mint:

Pros and cons of Mint:

- Offers advanced budgeting tools and features absolutely free.

- Easy connection with bank accounts, credit cards, and investments gives a holistic picture of finances.ve

- Users can track their credit score through Mint.

- Streamline bill management.

- Vast information can overwhelm users.

- Limited customization options.

Pricing Structure of Mint:

- No subscription fees or in-app purchases.

- Users who need advanced features and get rid of ads are required to take a premium subscription of $4.99 per month.

- Google Play Rating: 4.0

- Apple Store Rating: 4.8

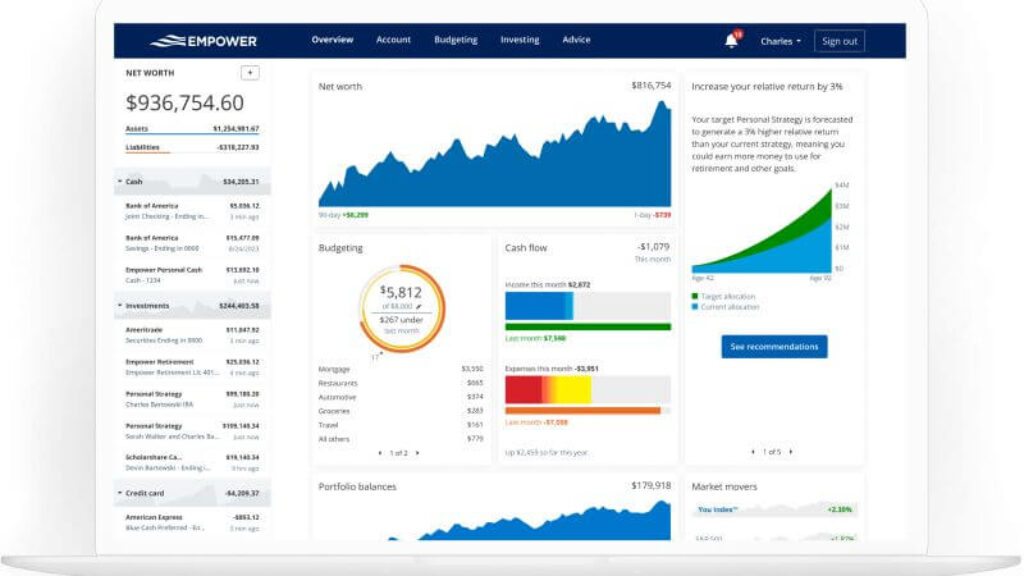

Empower

Empower is another best budgeting app for couples who are serious about managing their funds and experiencing financial freedom in the future. This app is not only for couples but also for individuals who seek a valuable tool to manage their funds. This best free budgeting app for couples allows you to track and monitor your finances at your affordability. You can create saving goals, and measure expenses, and income to estimate the rate of savings.

Key Features of Empower:

Pros and Cons of Empower:

- Ease of understanding financial health by monitoring expense and income.

- Categorize income and expenses automatically.

- User-friendly interface and is best for beginners.

- Enables users to stay focussed to achieve long and short-term financial goals.

- Limited features for couples like shared budgets and goal tracking.

- Limited customization options.

- Sometimes requires manual corrections.

Pricing Structure:

- 30-day free trial.

- $6 per month to access features after the free trial is over.

- Google Play Rating: 4.1

- Apple Store Rating: 4.7

Goodbudget

Formerly known as EEBA (easy envelope budget aid), Goodbudget is another couple budgeting app to reach financial goals quickly. This app is based on a classic envelope budgeting method that enables couples to allocate their income digitally in virtual envelopes based on different categories such as rent, groceries, entertainment, etc.

Key Features of GoodBudget:

Pros and cons of GoodBudget:

- Easy collaboration between couples to track income and expenses together.

- Setting joint financial goals and monitoring the progress is easy.

- Users can generate reports to examine their spending and find areas for improvement.

- Simple and user-friendly interface.

- Both partners can update and access the budget.

- Lacks features like bill payment notifications and investment tracking.

- Fewer customization options.

Pricing Structure of GoodBudget:

- The basic plan is free.

- The Plus Plan costs $7 per month.

- Google Play Rating: 4.1

- Apple Store Rating: 4.6

Monarch Money

Monarch Money is one of the most popular budgeting apps for couples. This app offers many customization options. Monarch Money enables users to manage their paychecks and track spending behavior. It is a comprehensive financial management platform that helps couples in budgeting like a pro. Managing finances in this app is very straightforward where couples can visualize their funds and set attainable goals together.

Key Features of Monarch Money:

Pros and cons of Monarch Money:

- Offers finance calculating tools to estimate and track debt repayments.

- Clean and straightforward interface.

- Couples can set and track achievable financial goals like saving for a house.

- Comprehensive financial planning.

- The free trial comes with limited functionalities.

- Requires monthly subscription to access advanced features.

Pricing Structure of Monarch Money:

- 7-day free trial.

- The Premium Plan costs $8.33 per month.

- Google Play Rating: 4.7

- Apple Store Rating: 4.9

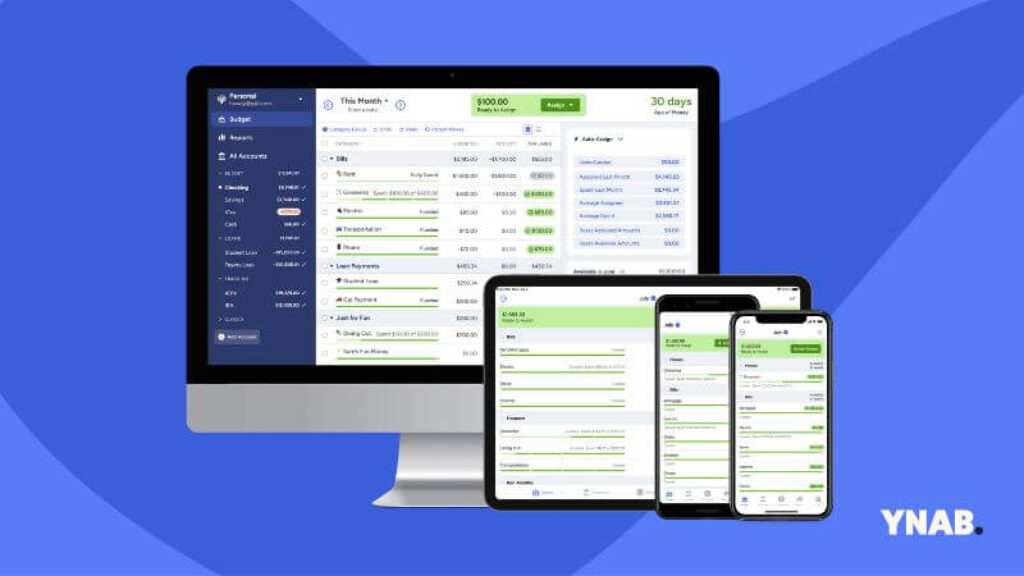

YNAB

YNAB stands for ‘you need a budget’ and is another of the best couple budgeting apps. Unlike other budgeting apps on our list, YNAB emphasizes allocating every dollar earned to a particular purpose before spending it which is known as envelope budgeting. This method gives you more control over your funds and attain financial goals. It is a powerful budgeting tool for couples to gauge their virtual envelope before spending it anywhere.

Key Features of YNAB:

Pros and cons of YNAB:

- Allow users to do proactive budgeting and prevent overspending.

- Keep users motivated by suggesting mindful spending.

- Customizing options enables users to set specific goals and budget categories.

- User-friendly interface offers easy navigation and learning for beginners.

- Comes with 34 days free trial before purchasing the premium plan.

- Requires monthly or annual fee to access vital budgeting features.

- Envelope budgeting can take time to learn and get used to.

Pricing Structure of YNAB:

- 34-day free trial.

- The premium plan will cost $ 14.99 per month and $99 annually.

- 100% money-back guarantee if not satisfied.

- Google Play Rating: 4.6

- Apple Store Rating: 4.8

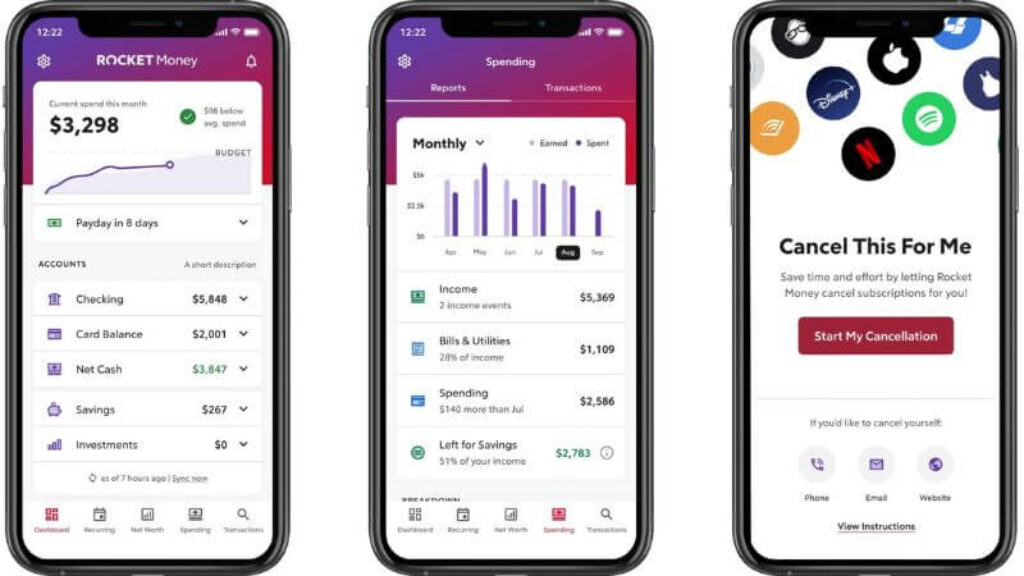

Rocket Money

Rocket Money is one of the best budgeting apps for couples that helps them track banking transactions and spending. This app comes with features such as automated savings, subscription management, budgeting, and bill negotiation. Not only for couples, but Rocket Money is also a beneficial tool for joint financial management.

Its free plan is good for saving money, and tracking expenses. However, you should purchase a premium plan for accessing advanced tools such as shared accounts, subscription cancellations, unlimited budget categories, etc.

Key Features of Rocket Money:

Pros and cons of Rocket Money:

- The free plan allows couples to track spending, manage subscriptions, and categorize transactions without spending a penny.

- The bill negotiation feature negotiates various bills on your behalf to increase your savings.

- Budgeting and financial management are automated.

- Couples can track expenses, income, and goals together.

- Lacks essential features such as breakdown of spending and objective-based budgeting.

- Keeps 40% of savings after successful bill negotiation.

Pricing Structure of Rocket Money:

- The basic plan offers budgeting and account tracking features.

- The premium plan with advanced features will cost $4 to $12 per month or $47.99 to $59.99 annually.

Final Note on Best Budgeting Apps For Couples

Now you know the 07 best budgeting apps for couples, go through every feature, understand their pros, cons, and costs, and pick the one that matches your requirements. These valuable budgeting tools not only keep you both on the same page but also help you progress toward your goals.

Get ready to leave all the finance-related worries at bay, start using any of these budgeting apps, and be the star couple in your social circle!